Stocks depletion at risk

ICE Brent prompt prices weakened at 68.4 $/b, as the dollar rebounded. Fundamentals remain somewhat weak, as Japanese commercial stocks built, amid a continued drop…

Get more analysis and data with our Premium subscription

Ask for a free trial here

Looking at markets’ reaction after the ECB meeting, the new forward guidance is a success: the euro is slightly weaker vs the USD (around 1.1770) and bond yields have eased a bit (-2 to 3bp for the Italian 10Y for example). The message was broadly dovish: the ECB will not consider interest rate hike unless it sees inflation coming back to 2% within 12 to 18 months (that was not said explicitly yesterday but this morning by the French CB governor) and to stay durably there. The ECB could even tolerate “a transitory period in which inflation is moderately above target”. As far as bond purchases are concerned, no change until the September meeting at last and the Purchases under the Pandemic emergency purchase program (PEPP) will continue “until March 2022 at least” and “until the ECB judges that the Covid crisis is over”. But overall, these announcements are everything but a surprise. You can find everything about yesterday’s meeting here.

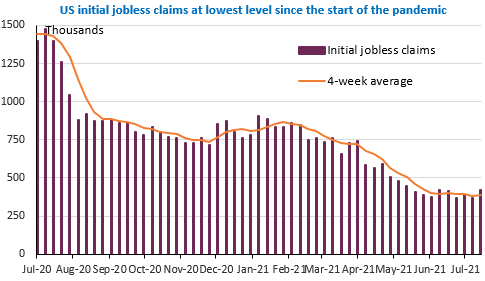

Stock markets have continued to recover otherwise, despite the quick spread of the Delta variant. Bond yields have stabilized and even started to edge down nevertheless (US 10y at 1.28%). In the US, jobless claims rebounded to 419k last week. They have actually stabilized at a high level since early June, which seems indeed to reflect abnormal behavior of the US job market.