Prices ease in the hope of an end to the crisis with Russia

Crude oil prices eased quite significantly following the French President’s visit to Russia. There was nothing concrete, however, other than Vladimir Putin’s reported promise not…

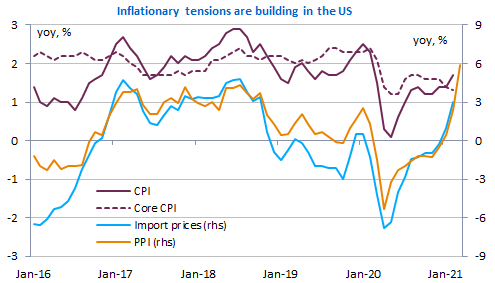

As the Fed chairman said during the week-end, the US economy is ready for a very strong recovery, but the economic outlook remains dependent on the pandemic evolution. He may have added that the inflation risk is not negligible either, even though the Fed never stops telling markets this is only going to be a temporary uptick due to energy prices. Despite a very efficient vaccination campaign, signs of resurgence in Covid-19 are real in the US and producer prices figures really topped expectations in March. The USD is regaining some ground: the EUR/USD exchange rate is trading below 1.19.

Get more analysis and data with our Premium subscription

Ask for a free trial here