Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

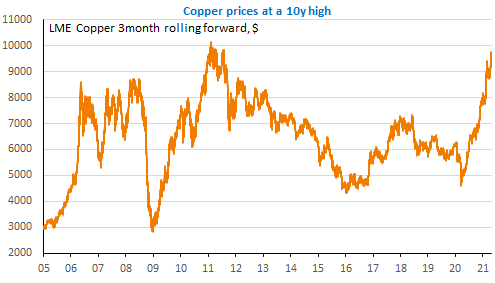

Financial markets are rather calm in general, with limited moves on equities, bonds and FX. The EUR/USD exchange rate has edged down but remains not far from 1.21, around 1.2075. Key economic reports are coming this week as well as a Fed meeting and the presentation by Mr. Biden of his American Families Plan that will be funded by significant tax increase on the wealthy. Caution is therefore indeed required. Copper prices have reached a 10y high on expectations of strong economic recovery in the US and strong demand linked to the infrastructure plan. The continued rise in the copper-to-gold ratio also sends a key signal to the bond market, as it is generally a good leading indicator of bond yields.

Get more analysis and data with our Premium subscription

Ask for a free trial here