Bond yields and the euro rebound

We spent the week noting the curious decline in bond yields while the US figures were frankly good. If they rebounded yesterday, it was not…

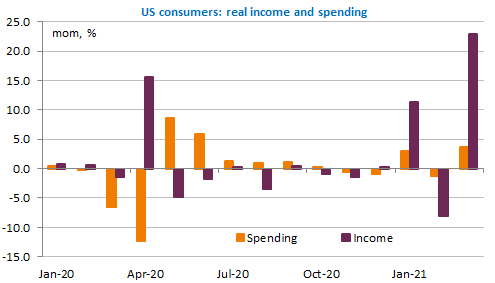

The EUR/USD exchange rate plunged by more than 1$ on Friday and is now trading just above 1.20. The preliminary estimates of Q1 GDP growth confirmed the double-dip recession in the euro area, while US March figures showed a record strong increase in personal income that foresees super strong growth in consumer spending for the months ahead. Moreover, a non-voting Fed member sent a noticeable warning about the Fed’s ultra-accommodative policy. Manufacturing PMI and ISM will be released today. Bank holiday in the UK.

Get more analysis and data with our Premium subscription

Ask for a free trial here