Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

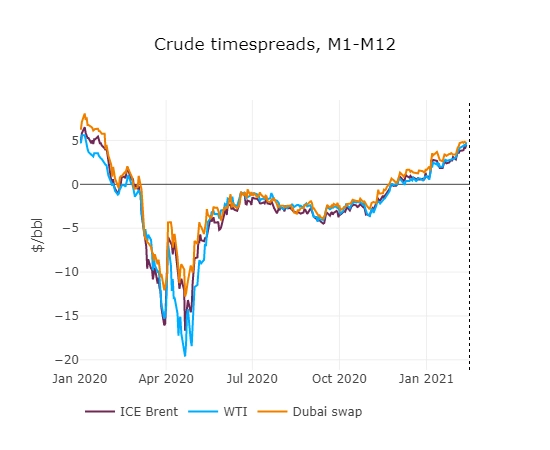

Brent futures prices rallied, with prompt contract reaching 63.5 $/b on late Friday, as a cocktail of supply risk were hitting the oil market. First, tensions between Yemen’ Houthis and Saudi Arabia grew, with the Saudi coalition declaring it had intercepted a missile strike directed towards airport infrastructures. Secondly, Texas’ ultra-cold weather spooked market participants with power markets reaching 2000 $/MWh at the day-ahead auction. Effects are quite hard to anticipate for oil markets as both supply and demand side of the equation are affected. Finally, satellite imagery inventory trackers showed another large draw in Cushing of 3 mb, pushing time spreads higher.

Get more analysis and data with our Premium subscription

Ask for a free trial here

We will get back in touch with you soon.

Don’t forget to follow us on twitter!