Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

On Sunday, OPEC+ members met for a rapid meeting, delivering a suite of production decisions going forward. The current production agreement between OPEC nations and non-core members including Russia, Kazakhstan is therefore extended to the end of 2022 vs April 2022 for the current deal. Furthermore, the group plans to execute monthly supply increases of 0.4 mb/d from August to April 2022. We expected a more modest ramp up in crude supply, of about 0.3 mb/d per month for core OPEC+ members, and about 0.05 mb/d per month for non-core members. Post-April 2022, the group will be allowed to pump monthly increments of 0.43 mb/d. Members will still meet monthly to decide the best course of action.

Looking at country baselines, the UAE, Iraq, Saudi Arabia, Russia and Kuwait all got upward revision for their production quotas post-April 2022. More specifically:

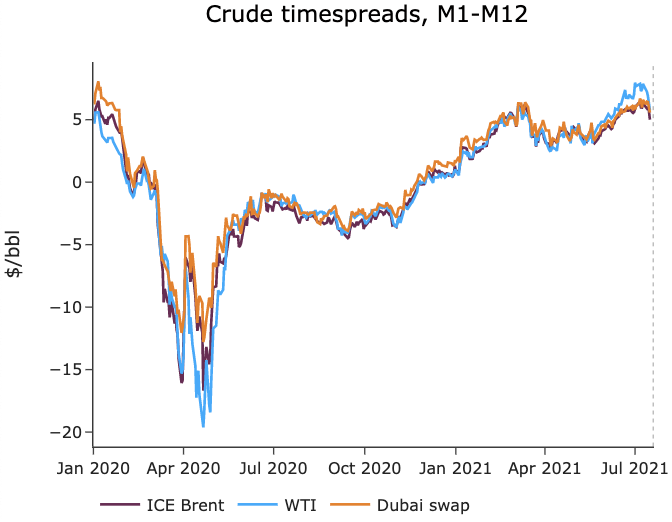

On this backdrop, OPEC+ supply seems to be plentiful for 2022. Prompt and long-dated oil futures declined to 72.7 $/b for ICE Brent contracts. Despite signs that crude buying in Asia remained somewhat weak, global crude inventories kept shrinking, partly to be transformed to refined product inventories, but also because we envision a rather tight summer supply picture of about 2.5 mb/d crude deficit in August/Sept, despite the recent OPEC+ announcements.

Get more analysis and data with our Premium subscription

Ask for a free trial here

ARA inventories continue to reflect this uneven scarcity across refined products. Naphtha and gasoline stocks plunged this week by 1.5 mb combined. Following the historic floods in Germany, this decline could persist, as rising Rhine water levels are making it impossible to ship barges of refined products (coming from inland refineries in Germany) through the river. Diesel stocks remained constant last week, while jet fuel stocks remained elevated, despite rising European flight numbers.