Prices maintain their bullish trend

European gas prices were up overall yesterday, still supported by uncertainties on Russian supply and LNG flows (following the shutdown of the US Freeport LNG…

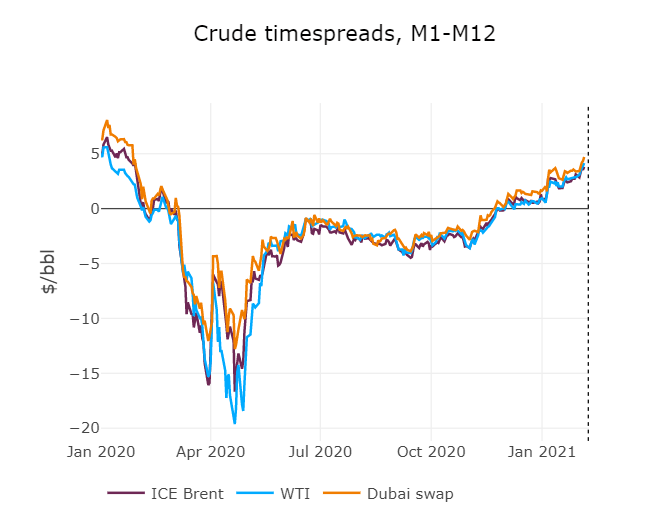

Brent prompt future contract approached topped 60 $/b on early Monday, as the successful OPEC meeting on last week continued to tighten crude markets. However, January’s US employment remained disappointing, with a 49k increase in Non-farm payroll employment, while the long-term/permanently unemployed category continues to swell. Chinese oil imports are likely to reach 10.9 mb/d in January, rebounding strongly from December’s lows. CTFC data showed an increasing net long position in NYMEX WTI futures for financial players, while producers expanded their net short position.

Get more analysis and data with our Premium subscription

Ask for a free trial here