European prices up again

European spot gas prices increased yesterday, supported mainly by lower Norwegian supply. Indeed, Norwegian flows were significantly down, averaging 275 mm cm/day, compared to 309…

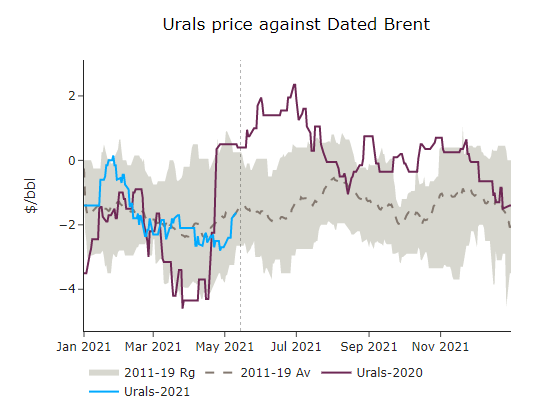

Crude oil prices scaled back to 66.9 $/b, amid the resolution of the US colonial pipeline issue on Thursday and selling pressure coming from CTA players in the rolling period of the month. The drop in flat prices was also due to a comparable decline in time spreads, indicating that prompt demand remains unusually low, with Gulf coast refiners likely easing runs to limit the impact of the Colonial pipeline, while Indian crude buying continues to be subdued. Singapore stocks, depicting the Asian product market dynamics, showed an increase in gasoline and diesel stocks, putting pressure on Asian margins.

Get more analysis and data with our Premium subscription

Ask for a free trial here