EUAs took a breath from last week’s rally

The European power spot prices remained rather stable yesterday, torn between expectations of higher power demand and weaker wind production, and forecasts of improved French…

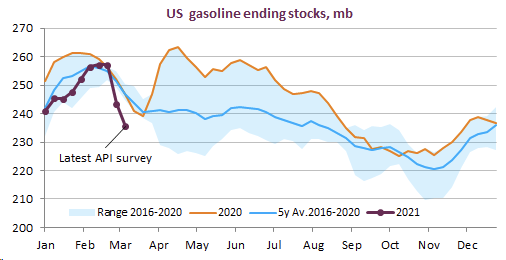

ICE Brent crude prompt future continued to weaken towards 67 $/b mainly due to a rather bearish API data survey, showing that the US crude market continued to be strongly oversupplied, while Texan refineries struggled to ramp up output. Japanese markets showed weakness too, as refining runs struggled to ramp-up despite falling oil products inventories.

Get more analysis and data with our Premium subscription

Ask for a free trial here