Markets still driven by stagflation fears

The April US jobs report was good with 428k new jobs and a slight slowdown in wages, but this did not stop long rates from continuing to…

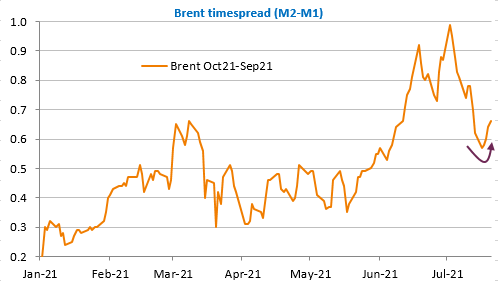

Brent prompt prices are back to their level of the start of the week: above $73/b. The sharp downward correction on concerns over the Delta variant ($67.44/b was touched on Tuesday) has been entirely erased, as risky assets in general posted a strong recovery and the oil market acknowledged it would remain under supplied during summer. The prompt time spread has jumped higher to 0.65/b in backwardation, a bullish pattern.

Get more analysis and data with our Premium subscription

Ask for a free trial here

The rebound in air traffic on both sides of the Atlantic is fueling optimism, although it remains some 35% below 2919 levels in Europe and road traffic appears to be declining due to increasing restrictions imposed to cope with the rapid spread of the virus on the continent.

Russia is ready to introduce a ban on gasoline exports as soon as next week to limit the rise in domestic prices. Such a measure had already been discussed in April without being implemented. Russia exported 5.83mt of gasoline last year according to Bloomberg calculation.