Tighter sanctions, but Russian supply continues to flow for the moment

European gas prices were very volatile yesterday, torn between the continuation of Russian gas exports (which averaged 247 mm cm/day yesterday, compared to 248 mm…

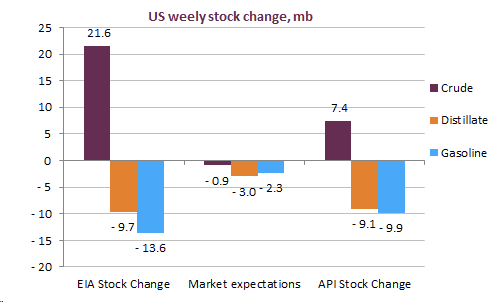

Brent prompt future contract significantly recovered yesterday, to reach 64.7 $/b. Crude prices were boosted by rumours that OPEC members could roll over the current production cut, which would overly tighten the market, according to our balances. At the same time, the EIA reported a shocking 21 mb crude inventory build, 3 standard deviations away from the average historical build, amid a markedly slower restart of US refineries. Products inventories dipped by unprecedented numbers, leaving total oil products inventories lower w/w.

Get more analysis and data with our Premium subscription

Ask for a free trial here