EUAs extended their rebound for a third straight day

The European power spot prices rebounded yesterday on forecast of weaker wind output and lower temperatures. Prices hence rose by 9.61€/MWh from the day prior…

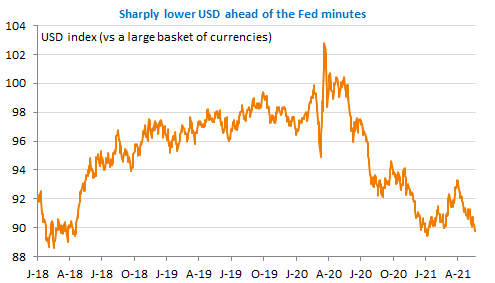

The USD is weakening quickly, as market participants expect the minutes of the last FOMC meeting to confirm the Fed’s willingness to tolerate a temporary surge in inflation. US equities posted losses for the second day in a row, but the bond market remained rather unchanged, with the US 10y around 1.64%. UK price data released this morning showed the inflation rate more than doubled in April, in line with expectations, but strong PPI figures point to further acceleration. Non-essential shops, cinemas, museums and café and restaurant terraces reopen today in France.

Get more analysis and data with our Premium subscription

Ask for a free trial here