Another day, another fresh record for carbon prices

The European power spot prices observed mixed variations yesterday, slightly up in France amid expectations of lower nuclear availability, but down in Belgium, Germany, and…

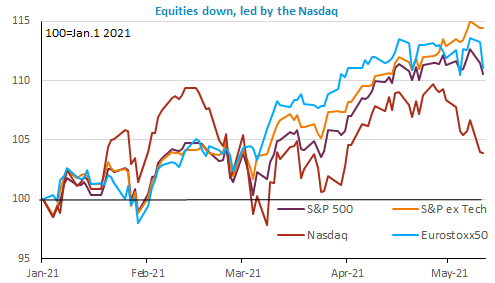

For the second day in a row, equity markets plunged yesterday on concerns about inflation, mainly in the US. The bond market was down as well (yields up), but more in the euro area, as there were big sovereign bond auctions, while expectations of reduction in the ECB’s bond purchases intensified. The FX market posted little reaction, the EUR/USD pair trading slightly lower near 1.2130 this morning, caught between opposite forces. The release of the April US inflation figures will be the main event today.

Get more analysis and data with our Premium subscription

Ask for a free trial here