Stimulus hopes drive crude prices higher

Brent prompt futures edged higher on Tuesday and early Wednesday at 56.2 $/b as US equity markets were on the rise, following Ms. Yellen’s stance…

Get more analysis and data with our Premium subscription

Ask for a free trial here

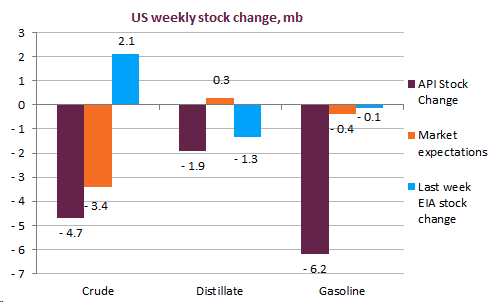

Crude prices were unevenly boosted by a constructive data release from the American Petroleum Institute, as ICE Brent prompt month reached 74.8 $/b on early Wednesday. Conversely, WTI prices rose at a slower pace, pushing the WTI-Brent to levels unseen since June, at 2.7 $/b for the November contract. We maintain that WTI-Brent spreads should narrow, even if the rising US production, currently at 11.4 mb/d, lowered the US net imports requirements. Looking at the API survey, crude inventories declined by 4.7 mb while gasoline and diesel inventories respectively declined by 6.2 mb and 1.9 mb. If these numbers were to be confirmed by the EIA today, this would represent a very constructive outlook for US petroleum markets. The US is now increasingly structurally short gasoline in the summer, as US gasoline demand may have reached record levels, according to GasBuddy data. RBOB cracks rallied back to 24.3 $/b at the prompt, reflecting the need for imported gasoline to match demand.