Rally in Atlantic gasoline markets

Crude prices remained supported to 71.8 $/b for ICE Brent prompt futures. As the EIA weekly release showed a seasonally average week, with stock draws in crude…

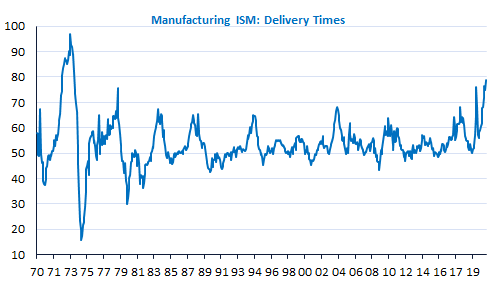

Markets are hesitant. It is a case of the glass being half full or half empty. The manufacturing ISM, the main US leading indicator, was high and up in May, but details of the reports were worrying about inflation. The Fed’s Beige Book will be closely watched today. The euro area inflation rate also reached 2% for the first time since 2018. The EUR/USD exchange rate remained stable, just above 1.22.

Get more analysis and data with our Premium subscription

Ask for a free trial here