Chinese runs in March remained strong

ICE Brent prompt month reached 67.1 $/b on early Thursday, as the dollar continued to weaken and new data on the Chinese refining sector showed sustained…

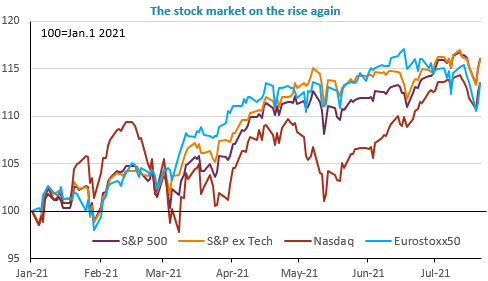

Nothing particular to explain this change of trend except the fact that pessimism was likely excessive and, above all, the fall in bond yields difficult to justify. This being said, it looks like these erratic market moves could continue, as no good news on the spread of the delta variant can be expected in the foreseeable future.

On the agenda today, the ECB meeting with changes expected in its guidance to reflect its strategic moves, but we doubt it can really surprise markets. US jobless claims and the leading index in the US as well as the CBI survey in the UK.

Get more analysis and data with our Premium subscription

Ask for a free trial here

Concerns about the spread of the Delta variant seem to have significantly diminished suddenly: bond yields rebounded, the US 10y nearing 1.3%. Stock markets were on the rise, sharply in Europe with increases of around 2% on average, and commodity prices rebounded as well, led by oil. The USD weakened logically in this context and the EUR/USD exchange rate edged up to 1.18, while the GBP rebounded (EUR/GBP now trading below 0.86).