EUAs reversed on surging equities after a mostly bearish session

The European power spot prices edged down yesterday on forecasts of slightly higher wind output and temperatures. Prices reached 60.91€/MWh on average in Germany, France,…

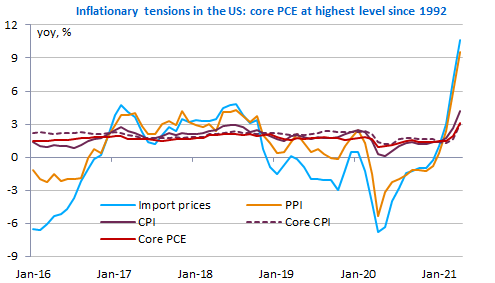

The Fed’s preferred measure of inflation accelerated to +3.1% yoy in April, but equities advanced further and the 10y bond yield fell below 1.6%. Markets still consider those tensions will remain transitory. The Chinese PMIs were solid in May, confirming the strengthening in domestic activity. By contrast, Japan looks closer to recession after weak retail sales and disappointing industrial output figures. The EUR/USD exchange rate remains rather stable near 1.22.

Get more analysis and data with our Premium subscription

Ask for a free trial here