Pause

Yesterday was a day of transition or “breathing space” on the markets. There was little movement on rates, which even fell slightly in the US…

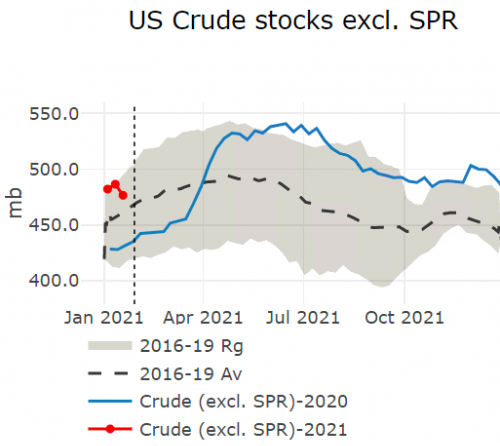

Brent futures contracts dipped on Wednesday and early Thursday, with the prompt month contract at 55.4 $/b, as all risky assets tanked amid broader market concerns about the macroeconomic backdrop. Furthermore, the EIA reported a large crude inventory draw of 9.9 mb, but mostly due to volatile net imports. The Norwegian field Johan Svredrup is expected to reach its daily capacity by mid-2021, at 535 kb/d.

Get more analysis and data with our Premium subscription

Ask for a free trial here