Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

The European power spot prices for today rebounded compared to Friday amid forecasts of lower temperatures and dropping wind output. Prices reached 50.35€/MWh on average in Germany, France, Belgium and the Netherlands, +13.97€/MWh from Friday but -11.25€/MWh from the previous Monday as the wind production should be stronger today.

The French power consumption slightly eased by 0.28GW to reach 59.58GW on average on Friday while the country’s nuclear generation rose by 0.40€/MWh to 43.30€/MWh. Although slightly fading by 1.56GW from Thursday, the German wind production remained very high at 40.93GW on average and even increased to 41.80GW on Saturday, before starting to sharply ease from Sunday. The production is expected to plunge this week and fall down to 8.50GW by Wednesday.

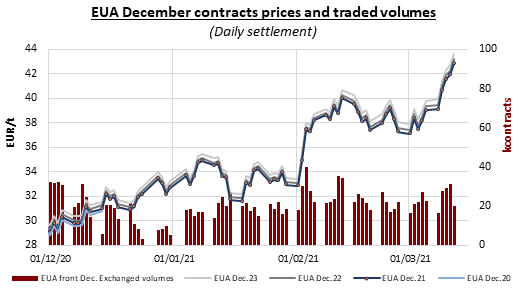

The buoyant oil and financial markets and supportive energy complex pushed the EUA prices to a fresh record high for the fourth day in a row on Friday, the Dec.21 benchmark contract hitting up to 42.90€/t at the end of the session with possible additional support from the late compliance companies. The carbon prices slightly corrected in the morning, tracking a similar short-lived retracement in the financial markets, but sharply rebounded in the afternoon after hitting the 5-day moving average technical support and the morning’s cleared with a strong 2.04 bid coverage (despite a rather weak 0.11€/t discount to the secondary market).

The power curve prices posted hefty gains along the curve on Friday (although slightly lower in the calendar contracts), lifted by the bullish rally and of emissions and stronger gas prices.

Get more analysis and data with our Premium subscription

Ask for a free trial here