Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

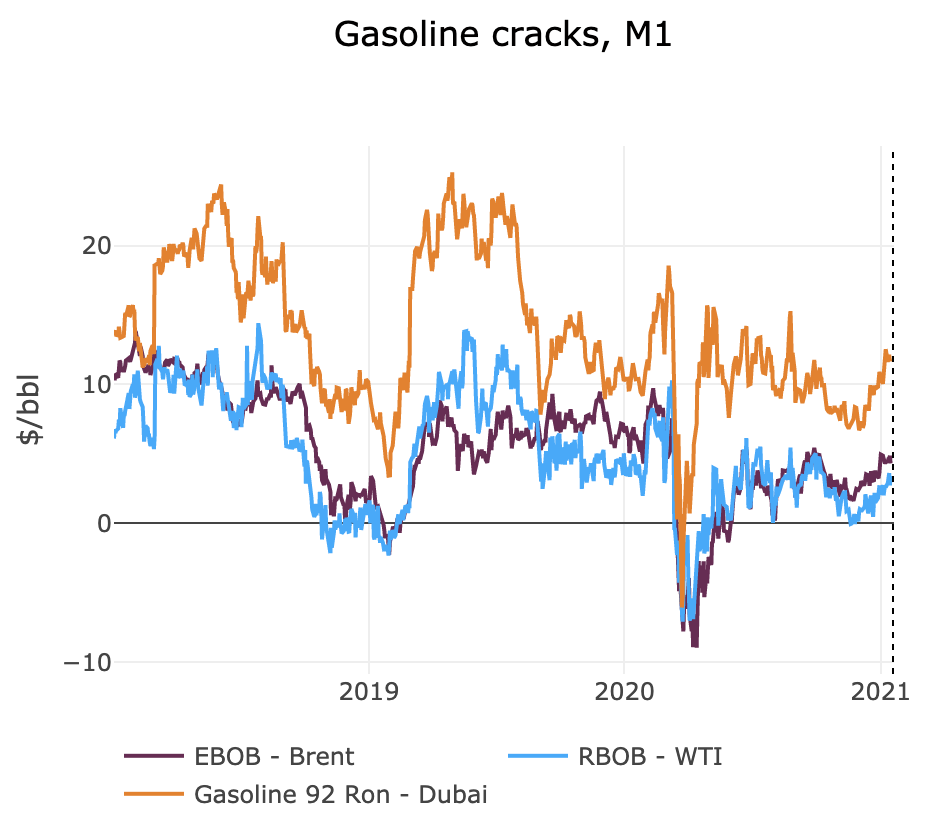

Brent futures prices continue to be under pressure across the curve as rising coronavirus cases in China clouds the outlook for demand. Physical crude grades associated with Chinese crude buying retreated, as Chinese independent refiners prefer to consume their crude stockpiles in case spot prices were to weaken significantly more. However, Asian gasoline prices remain broadly supported by the scarcity in naphtha cargos, which are bidding up common refining components, combined with higher fuel oil yields due to the cold Asian weather reviving utility demand. US shale producers continued to add onshore rigs last week following early January’s rally.

Get more analysis and data with our Premium subscription

Ask for a free trial here