Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

European spot gas prices were mixed again yesterday, unable to find a strong driver. Prices on the curve were more clearly up, more sensitive to the increase in parity prices with coal for power generation than to the drop in Asia JKM prices.

On the pipeline supply side, Russian flows were almost stable yesterday, averaging 312 mm cm/day (compared to 311 mm cm/day on Wednesday). The same for Norwegian flows, which averaged 319 mm cm/day, compared to 318 mm cm/day on Wednesday.

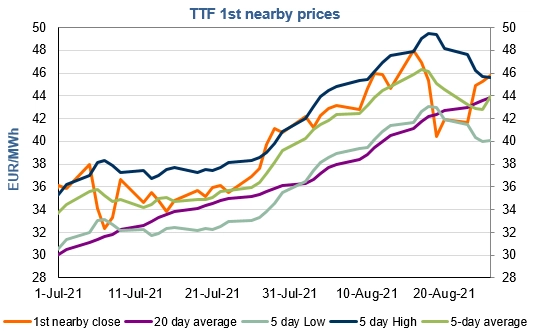

At the close, NBP ICE September 2021 prices increased by 1.770 p/th day-on-day (+1.56%), to 115.100 p/th. TTF ICE September 2021 prices were up by 50 euro cents (+1.11%) at the close, to €45.788/MWh. On the far curve, TTF Cal 2022 prices were up by 15 euro cents (+0.47%), closing at €31.952/MWh, above the coal parity price (€31.097/MWh).

After yesterday’s rise, prices have returned to technically overbought territory. Therefore, profit taking by financial participants could now exert downward pressure. However, uncertainty over the start up of the Nord Stream 2 pipeline after the German court ruling and technical supports (€44.682/MWh on TTF September 2021 and €31.645/MWh on TTF Cal 2022) could contribute to limit losses.

Get more analysis and data with our Premium subscription

Ask for a free trial here