EUAs rebounded amid stronger wider energy and financial markets

The power spot prices in north western Europe were mixed yesterday, slightly up in Germany and France but a bit lower in Belgium and the…

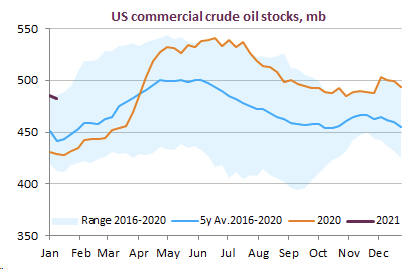

Brent prompt future prices retreated by 1$ at 56 $/b as most European countries doubled-down on restriction measures due to the expansion of the new strain of coronavirus. However, improved market conditions in the US, with an inventory draw in US commercial stocks and higher refining runs, are helping prices to potentially solidify at current levels. Chinese customs detailed preliminary trade data, showing December’s crude oil imports 15% below November’s level.

Get more analysis and data with our Premium subscription

Ask for a free trial here