Confidence bends but does not break

Fed members are making more and more statements in favour of a strong and accelerated tightening of monetary policy. The market is pricing in 87% for…

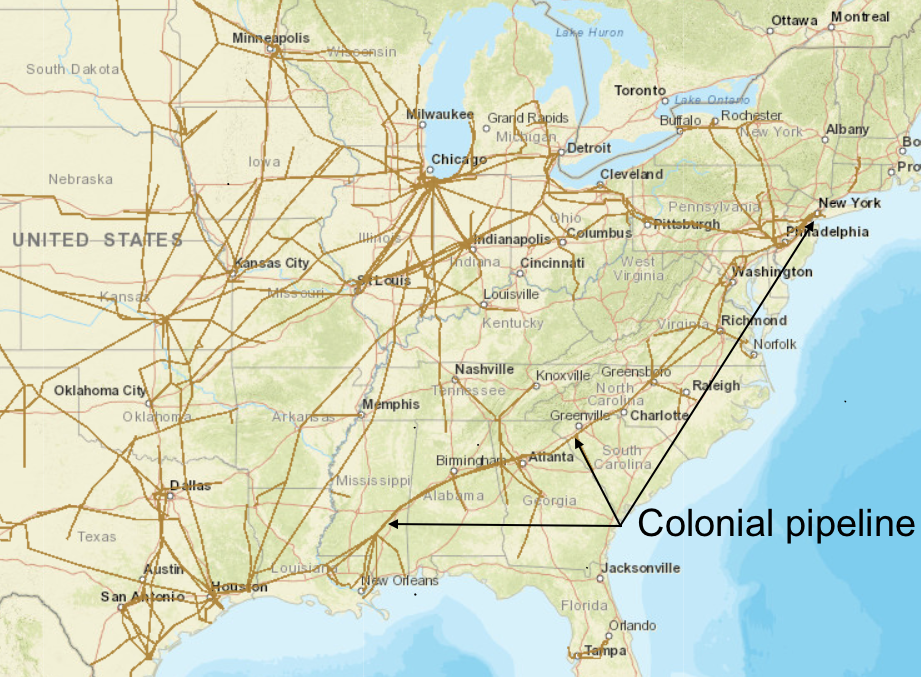

ICE Brent prompt prices were supported at 68.8 $/b by a rapidly weakening dollar and the shut down of the US colonial pipeline on Friday evening, which transports about 2.5 mb/d of petroleum products through the US from the Gulf Coast to the East Coast. Tankers were already being chartered as soon as Saturday to mitigate the risk of shortage for the Atlantic coast. If the issue lasts more than 3 to 5 days, we could see significant drawdowns on gasoline and diesel stocks.

Get more analysis and data with our Premium subscription

Ask for a free trial here