Another day of reversing market

Oil prices went up yesterday: on NYMEX, WTI front month gained less than 0.1%, ending at $105.17/b. On ICE, Brent price was +0.4% up to…

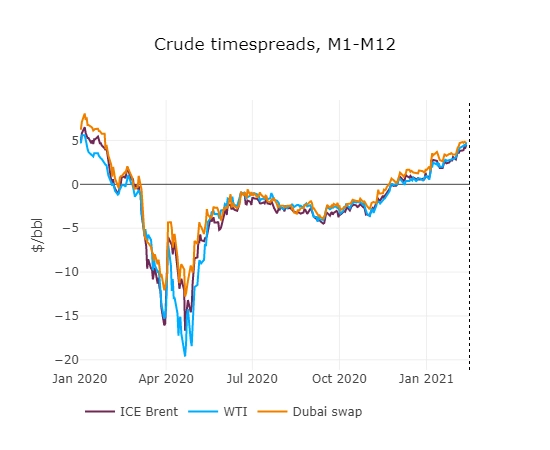

Brent prompt future contract came back to 63.5 $/b on early Tuesday, as Texas’ cold snap affected the US petroleum markets in unpredictable ways. WTI-Brent spreads collapsed, likely caused by lower US refining runs, pushing crude stocks higher in the short term. The two fields Troll and Johan Sverdrup in Norway were expected to shut down if workers declared a strike. A settlement was found before the strike could begin.

Get more analysis and data with our Premium subscription

Ask for a free trial here

We will get back in touch with you soon.

Don’t forget to follow us on twitter!