Growth deceleration

Global bond yields continued to decline, with short term interest rates left unchanged by South Korean and Japanese central banks. Equities continued to trade sideways in the…

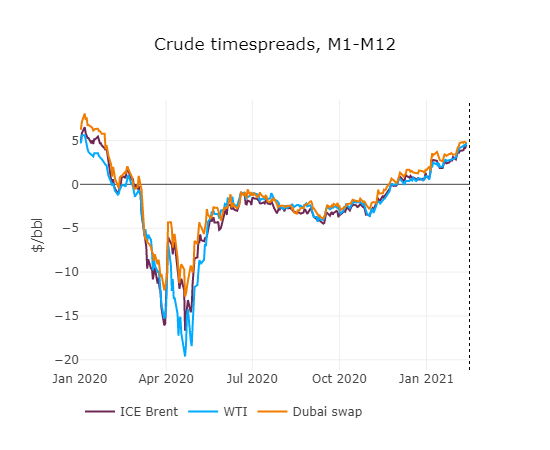

Brent prompt future contract came back to 63.5 $/b on early Tuesday, as Texas’ cold snap affected the US petroleum markets in unpredictable ways. WTI-Brent spreads collapsed, likely caused by lower US refining runs, pushing crude stocks higher in the short term. The two fields Troll and Johan Sverdrup in Norway were expected to shut down if workers declared a strike. A settlement was found before the strike could begin.

Get more analysis and data with our Premium subscription

Ask for a free trial here