Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

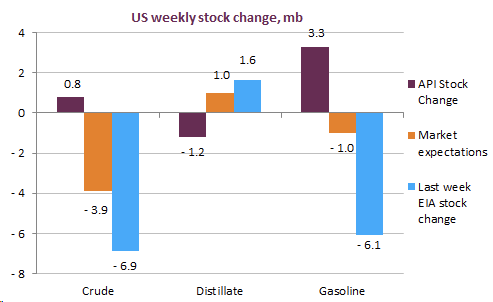

Crude prices remained at 69 $/b for the September ICE Brent contract, as the API survey showed stock builds in the US, whereas the market consensus expected draws in crude and gasoline inventories. Indeed, the industry survey reported that crude inventories might build by 0.8 mb, while Cushing stocks were depleted by 3.9 mb. This would require large builds in the PADD3 region, when we see little evidence of a large rise in US net imports, as US crude exports were recorded at 2.9 mb/d for the week in question by Kpler’s measurements. On the refined product side, gasoline stocks may have built by 3.3 mb, while refinery runs expanded by 0.4%. This would likely require large inflows of refined product imports or a drop in gasoline demand, despite not seeing any material change in US mobility data.

Get more analysis and data with our Premium subscription

Ask for a free trial here

We will get more clarity on the US petroleum markets this afternoon with the weekly DOE data release. The release will greatly affect the September/October WTI time spread which has become the front-month spread since yesterday’s August contract expiry. We remain constructive on time spreads, despite the recent steep decline in time spread values, as stock draws should resume for the next weeks.