EUAs traded rangebound amid mixed signals

The European power spot prices faded yesterday on forecasts of stronger wind output and warmer temperatures dampening the power demand. Prices eroded 7.74€/MWh to 50.70€/MWh…

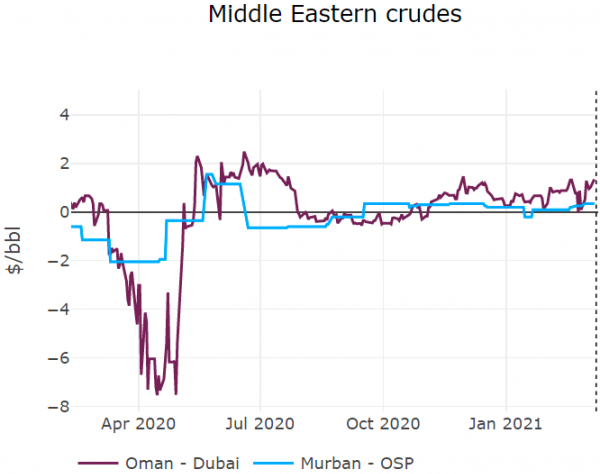

ICE Brent crude prompt future dipped to 67.7 $/b after a reaching 71$ yesterday following the Houthis attack on Ras Tanura terminal. With no material impact on the Saudi oil infrastructure, the rally was poised to be short-lived. Yet, this could be a new hindrance to the normalization of the US-Iran relationship. The current softness in prices was likely caused by a strengthening dollar, pushing dollar-denominated commodities down. Yet despite the last two month of dollar weakness, preliminary trade data from China shows signs of modest growth, far from a super-cycle type of growth.

Get more analysis and data with our Premium subscription

Ask for a free trial here