Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

Forecasts of below average temperatures and wind output shortage lifted the European power spot prices for today which reached 61.60€/MWh on average in German, France, Belgium and the Netherlands, +10.34€/MWh from Friday and +12.02€/MWh week-on-week.

The dropping temperatures strengthened the French power consumption on Friday which rose by 2.03GW from the day prior to 60.60GW on average. The country’s nuclear generation however faded by 0.31GW to 42.2GW but climbed to 43.36GW on Sunday. The German wind production increased over the weekend, from 7.82GW on Friday up to 15.26GW on average on Sunday, but should ease below 4GW today. The Wind production is however forecasted to surge in the upcoming days and climb above 40GW by Thursday.

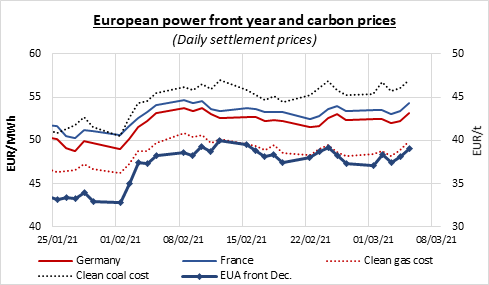

EUAs started Friday on a bearish tone, dropping below 38€/t after the morning’s auction cleared with a significant 0.16€/t discount to the secondary market and weak 1.57 cover ratio. The emissions prices however strongly rebounded in the afternoon, lifted by the surging oil and US equity prices amid prolonged OPEC+ oil production cut and surprisingly good US job data with the non-farm payrolls showing a 379 000 job increase last month, way above expectations. This reversal pushed the EUA Dec.21 contract up by nearly 1€/t and above the middle Bollinger band which had capped the gains over the past week, leaving room for more upside potential for the following sessions. The bellwether contract eventually settles at 39.02€/t with a 0.86€/t daily increase and 1.74€/t weekly gains.

The power curve prices posted hefty gains over the last session of the week, supported by the stronger gas and carbon prices.

Meanwhile, the German government and nuclear operators agreed today on €2.428bn of compensation payments to the operators for the country’s accelerated nuclear phase-out.

Get more analysis and data with our Premium subscription

Ask for a free trial here