EUAs reversed in the afternoon after climbing to a fresh record

The power spot prices eroded 9.17€/MWh to reach 55.15€/MWh on average in Germany, France, Belgium and the Netherlands, pressured by forecasts of stronger renewable production.…

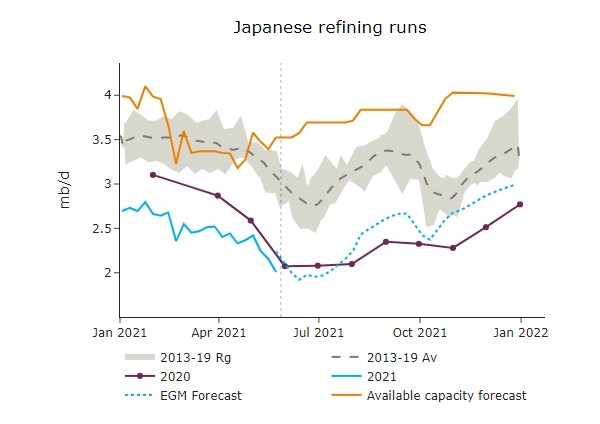

ICE Brent prompt prices weakened at 68.4 $/b, as the dollar rebounded. Fundamentals remain somewhat weak, as Japanese commercial stocks built, amid a continued drop in Japanese refining runs, markedly lower than seasonal patterns. Australia and Singapore were hit with a fresh batch of lockdown measures, limiting the upside for Asian runs. In the west, the weekly EIA report showed steep declines in their refined product stocks, while commercial crude stocks dropped by 1.7 mb. Refined products imports continue to be close to a record high, as the East coast region attracted cargoes coming from Europe.

Get more analysis and data with our Premium subscription

Ask for a free trial here