Westerners step up economic and financial pressure on Russia

In the financial markets, last week ended in an almost surreal atmosphere with very strong rises in the equity markets, so much so that the…

Get more analysis and data with our Premium subscription

Ask for a free trial here

ICE Brent prompt contract collapsed further yesterday, at 73.2 $/b for the September contract. The move was likely caused by two drivers:

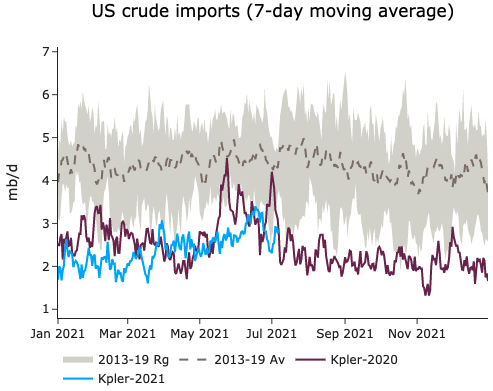

On the fundamental side, the API survey and Kpler are both recording steep draws in the US crude market, with a decline of 8 mb last week. More interesting, gasoline stocks dipped by about 2 mb according to the API survey, after few weeks of builds due to elevated imports from Europe. US imports from the Gulf coast are also finally ramping up according to satellite data, in line with the WTI-Brent spread recent narrowing. The EIA report due today should give us more insights into the US markets.