Sanctions against Russia tightened

The Biden administration has announced a ban on fossil fuel imports from Russia: oil, gas, coal. The British government has taken the same decision concerning…

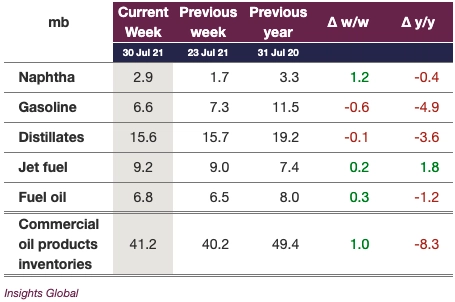

In Singapore, gasoline stocks rose by 1.5 mb, while diesel stocks dropped by 0.5 mb. Fuel oil stocks continued to decline at a fast pace in the East of Suez – 1.5 mb – amid strong power demand, narrowing the quality spread between clean and dirty products.

Get more analysis and data with our Premium subscription

Ask for a free trial here

Crude oil prices in Europe and the US continued to climb, to reach 76 $/b for the ICE Brent September contract. On the opposite of the spectrum, INE crude, Shanghai’s medium sour crude future expired for September’s contract at a significantly lower level than previous trading sessions, likely to reflect the growing concerns around a recent outbreak of COVID cases in the Jiangsu province. In Europe, constructive inventory data for transportation fuels (gasoline, jet fuel and diesel) in the ARA region support crude pricing at the prompt, while Singapore inventory data showed a more uneven trajectory. Indeed, European gasoline stocks continued to draw by 0.6 mb, to drop below the 5-year average in the ARA region, while gasoil stocks declined by 0.1 mb. Naphtha stocks jumped by 1.2 mb, despite the tightness of the naphtha market. Significant backwardation in the naphtha market indicates that this upward inventory move is unlikely to persist, amid strong petrochemical margins.