Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

Crude prices rapidly recovered from last week’s slumpy yesterday, with ICE Brent front-month contract rallying by more than 5%, to reach 69.3 $/b on early Tuesday. More interestingly, the whole curve rallied, with longer-dated time spreads such as Dec-21/Dec-22 gaining as much as 60 cents intraday, from 3.2 $/b. Indeed, on Monday, Mexico’s state-owned producer PEMEX reported a fire at one of its most prolific offshore basins, knocking out 450 kb/d of production capacity for an unknown duration. The producer was unable to inject natural gas for enhancing the field recovery due to security reasons, leaving no alternative but to stop the extraction for a large number of wells. As PEMEX and the Mexican government are known for their vast sovereign hedging program on the futures market, it is likely that some of the buying yesterday came for a reduction of short exposure coming from Mexico.

Refining runs in India recovered rapidly to 4.58 mb/d in July, according to the Indian energy ministry. Increased activity from Indian refiners tallies with the greater crude demand coming from India, addressed to international spot markets and its state strategic reserve, which converted sections of its strategic reserve to commercial storage this month.

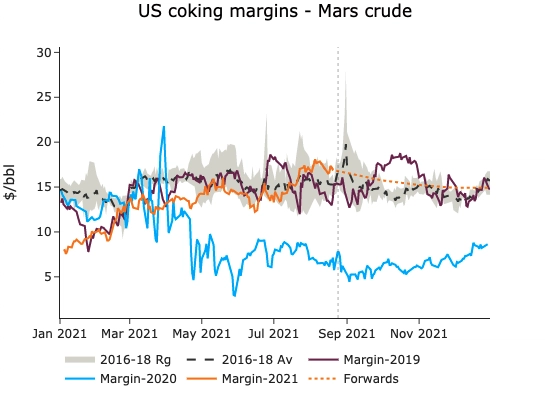

The largest refinery in the US, Motiva’s 600 kb/d gulf coast refinery, experiences an outage on their secondary units (reformer, FCC and coker) following a power outage, which could knock out their throughput by at least 50%. With backwardated refining margins and other refiners delaying their turnaround seasons, there is little doubt that Motiva will rush the completion of the maintenance to resume its operations.

Get more analysis and data with our Premium subscription

Ask for a free trial here