Prices maintain their downtrend

Prices were down again yesterday in most European gas markets, pressured by the increase in pipeline supply. Indeed, Norwegian flows rebounded, averaging 305 mm cm/day,…

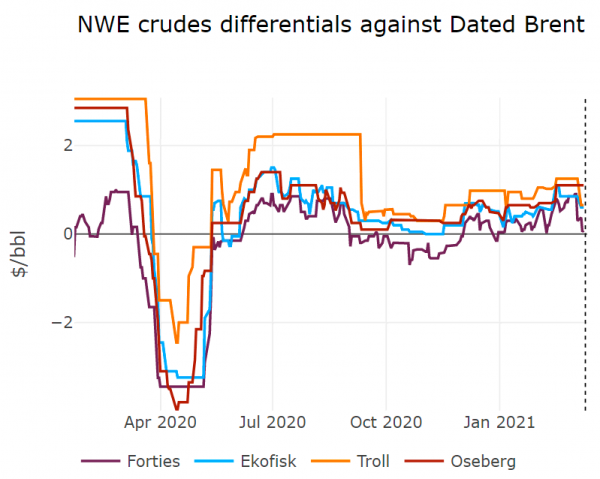

Crude prices remained broadly steady as the EIA weekly snapshot reflected a growing discrepancy between US crude oil and fuel markets with a net build in inventories of 1.3 mb. Similarly to last week, recovering refining runs in Texas was unable to follow the pace of crude production or fuel demand, leading to a 13.8 mb build in crude oil inventories and large draws in gasoline and distillate stocks. Weak Chinese crude demand continues to impact crude markets globally, with evidence of a slowdown in purchases in the West African market.

Get more analysis and data with our Premium subscription

Ask for a free trial here