Additional IEA stock release weighs on crude oil prices

Crude oil prices posted significant losses on Wednesday as the IEA announced an additional 60 Mb release from strategic stocks of its members, on top of the…

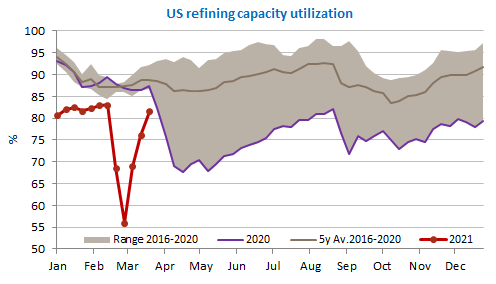

Brent 1st-nearby prices posted a $4/b gain yesterday. WTI prices did about the same. They respectively ended the day above $64.5/b and $61.2/b, therefore erasing their losses of the previous day. The main reason was the Suez canal still blocked by a giant ship that has deviated from its course for unclear reasons. Then, the release of the weekly EIA report in the US showed a new rise in inventories but normalization in demand from refineries as well, therefore pushing prices higher.

Get more analysis and data with our Premium subscription

Ask for a free trial here