Brent prices dip, following equity markets

Brent futures contracts dipped on Wednesday and early Thursday, with the prompt month contract at 55.4 $/b, as all risky assets tanked amid broader market…

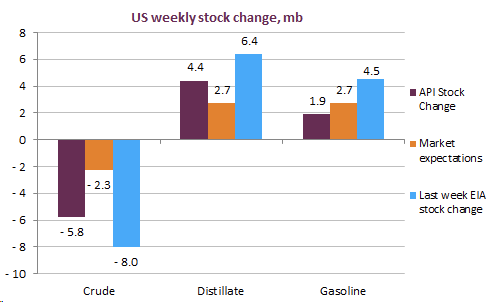

Brent prompt futures continued to hike, at 57$/b on early Wednesday as the API data showed a bigger than expected crude inventory draw in the US. Both gasoline and distillate stocks grew amid falling US demand and growing refining supply. In its latest Short-Term Energy Outlook, the EIA still predicts brent price to average 53$/b in 2021 and 2022 amid ample supplies and worsening global liquid demand.

Get more analysis and data with our Premium subscription

Ask for a free trial here

We will get back in touch with you soon.

Don’t forget to follow us on twitter!