Oil fell in the wake of equity market

Oil prices went down on Wednesday: ICE Brent for July delivery dropped by 2.5%, to settle at $109.11/b and NYMEX WTI for June delivery also…

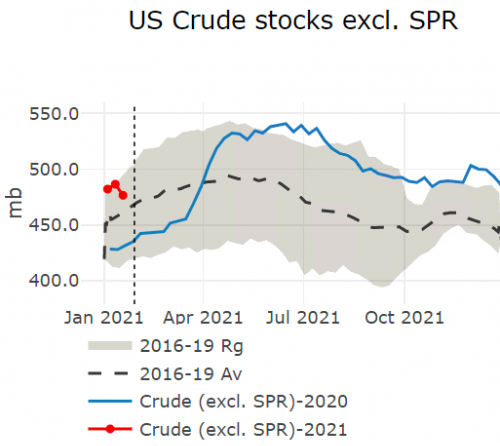

Brent futures contracts dipped on Wednesday and early Thursday, with the prompt month contract at 55.4 $/b, as all risky assets tanked amid broader market concerns about the macroeconomic backdrop. Furthermore, the EIA reported a large crude inventory draw of 9.9 mb, but mostly due to volatile net imports. The Norwegian field Johan Svredrup is expected to reach its daily capacity by mid-2021, at 535 kb/d.

Get more analysis and data with our Premium subscription

Ask for a free trial here

We will get back in touch with you soon.

Don’t forget to follow us on twitter!