Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

Brent

futures prices were stable at 55.5 $/b for the prompt future contract amid

growing concerns over new lockdowns, as Hong Kong declared a 2-day lockdown,

while France will likely implement one by the end of the week. The evolution of

the pandemic in China is also closely monitored, with strong actions from the

Chinese authorities despite the still modest spread of the virus. Both Libyan

and Nigerian exports will return to normal after two incidents. Libyan

exports were reportedly down by 20%, at about 200 kb/d. Finally, the

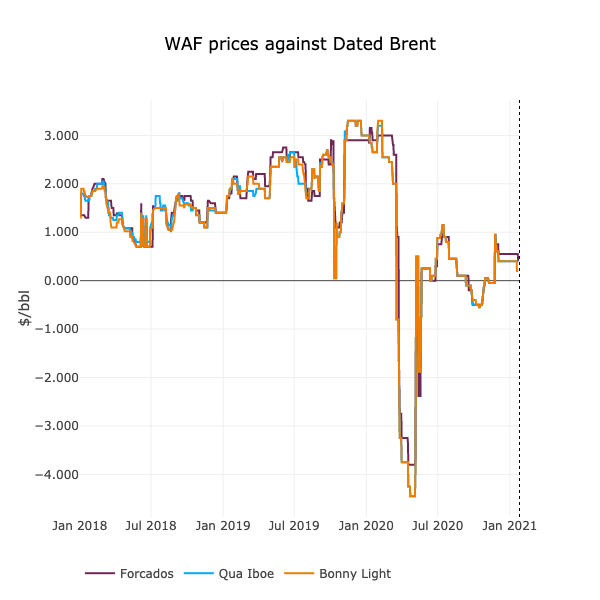

latest official selling prices from and loading programs from West African

countries are showing further weakness, pointing towards weaker physical price

for Asia’s marginal market. As prices consolidated around 55 $/b, US producers

managed to ramp up rig activity this week, in an effort to rebuild the DUC

backlog.

Get more analysis and data with our Premium subscription

Ask for a free trial here