Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

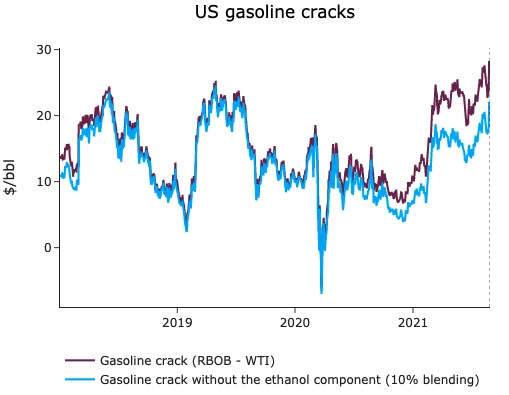

Crude prices remained supported to 71.8 $/b for ICE Brent prompt futures. As the EIA weekly release showed a seasonally average week, with stock draws in crude and products of about 5 mb (see report). Another drop in gasoline stocks, combined with emerging hurricane threats and some unplanned outages in Gulf Coast refiners, triggered an impressive rally in RBOB cracks. Given the level of gasoline imports required to supply the US (1 mb/d last week), RBOB prices continue to be elevated, to open the transatlantic arb. RBOB-WTI cracks now reached 21 $/b at the prompt, for October delivery, a usually weaker month for cracks. We believe the US crack will remain sustained throughout the end of the year, amid falling inventories in Europe and the US. Rising European runs between now and the end of the year will not fully balance the Atlantic basin, as European refineries gasoline yields are limited and naphtha demand remains strong throughout the year.

Get more analysis and data with our Premium subscription

Ask for a free trial here