All eyes on Russia and Ukraine

Oil prices remain stuck at their highs, around $96/b for Brent 1st-nearby. The market is fully focused on what is happening on the Russian-Ukrainian border. The…

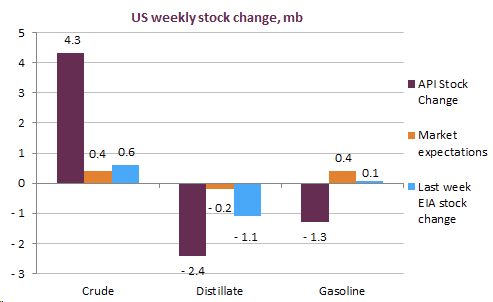

Crude prices climbed by about 0.5 $/b, to 66.7 $/b for ICE Brent prompt month contract, as OPEC+ members maintained their production policy in a rapid meeting held yesterday. However, the API survey showed a build in crude oil inventories of 4.3 mb while distillates and gasoline stocks dipped by respectively 2.4 mb and 1.2 mb. Japanese crude oil stocks declined by a 5.5 mb, despite a modest ramp-up in Japanese refining runs. The Galveston Bay refinery in Texas has now restarted its gasoline unit (FCC) which was down since the 8th of February after several trials.

Get more analysis and data with our Premium subscription

Ask for a free trial here