EUAs broke above all-time high on combination of bullish factors

Except in the Netherlands where it edged down, the power spot prices slightly increased in northwestern Europe yesterday with support from higher gas and carbon…

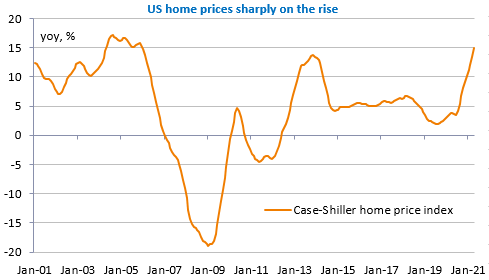

Much ado about nothing: the Fed minutes showed many Fed members getting more nervous about inflation and eager to discuss tapering bond purchases in order to react quickly if necessary. The most noticeable information that was not obvious after the Fed meeting was growing concern about the impact of monetary policy on the overheating housing market.

Get more analysis and data with our Premium subscription

Ask for a free trial here

Some members proposed reducing purchases of Mortgage Backed Securities in priority, but that could also mean rate hikes coming sooner than expected. Whatever, all this did not prevent US equities to reach new highs and the US 10y from going below 1.30%. The EUR/USD pair fell below 1.18 in parallel, which appeared at odds with the other markets’ reaction.

The EU Commission had also revised the euro area GDP growth forecasts sharply higher to +4.8% in 2021 and 4.5% in 2022. This appears voluntaristic, not to say very optimistic, given the supply problems limiting activity in the automotive sector in particular and the consequences of the spread of the Delta variant.

Main event today: the release of the ECB’s strategic review and Mrs. Lagarde’s press conference at 1 and 2pm CET respectively. The euro could weaken a bit further if it is confirmed that the ECB follows in the footsteps of the Fed by tolerating inflation above 2% from now on.