Late surge of oil and US equities pushed EUAs back above 39€/t

Forecasts of below average temperatures and wind output shortage lifted the European power spot prices for today which reached 61.60€/MWh on average in German, France,…

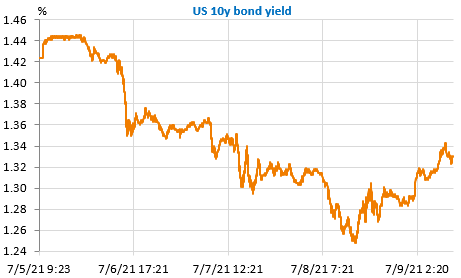

The exit from the “reflation trade” continued yesterday with a strong decline in equities and new lows for bond yields (1.25% for the US 10y). China fueled growth fears by signaling it could ease its policy very soon again. But the trend seems to be reversing (1.33% now): the sharp fall in bond yields has likely been amplified by technical factors and fears about the impact of the Delta variant on growth exaggerated.

Get more analysis and data with our Premium subscription

Ask for a free trial here

The ECB unveiled the outcome of its strategic review yesterday and conformed that the inflation target would now be 2% instead of “below but close to 2%”. Like the Fed, the ECB will also tolerate temporary overshooting and asset purchases will now include climate change criteria. The rebound in the EUR/USD that followed the announcement was likely a classic “buy the rumour, sell the fact” move. EUR/USD edged down again overnight to trade around 1.1830 now.

The economic agenda is light today. As explained above, the reflation trade could pick up some steam today.