The equity market looks increasingly nervous

The equity market plunged yesterday, allegedly on comments from Janet Yellen that interest rates could rise as a result of massive stimulus packages in the…

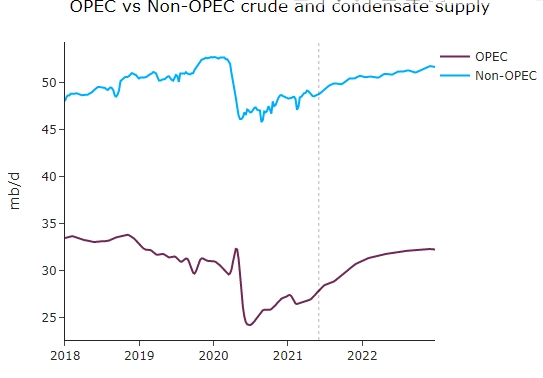

Strong uncertainty around the timing of a potential return of Iranian oil on the market pushed the OPEC+ group to just confirm what had been decided previously: output will increase further in July, but nothing is planned afterwards. Brent 1st-nearby prices almost touched their highest level of the year, above $71/b, before adjusting slightly downwards. The WTI reached a two-year high.

Get more analysis and data with our Premium subscription

Ask for a free trial here