Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

The Brent 1st-nearby price jumped higher from below $69/b to above $72/b, while the WTI posted an even-bigger rebound from around $66.5/b to $70.3/b now. Crude oil prices followed the general trend in risky assets that had declined excessively in the previous days. In the short-term, the oil market remains under-supplied, which should prevent any strong downward correction.

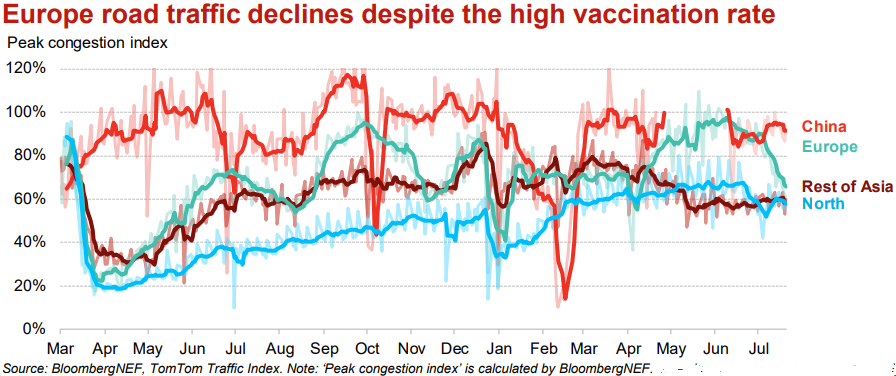

Yet, the news flow has been rather negative on the oil market with the rebound in US crude stocks last week (+2.1mb). but WTI prices were specifically supported by the fall in Cushing stocks and demand for oil products remained robust, mainly thanks to distillates. You can find every detail about the EIA weekly report here. According to unofficial sources, China has also supplied 3milliion tons (22mb) of strategic reserves to local refiners at the start of the month in order to cool oil prices. Finally, indicators of road traffic have started to reflect raising restrictions implemented to limit the spread of the delta variant reports Bloomberg, especially in Europe. This is likely to be the case in Asia too.

Get more analysis and data with our Premium subscription

Ask for a free trial here