Triple digits fuel prices emerge

Gasoline prices spiked yesterday in Asia, with Singapore’s benchmark 92 RON cracks reaching 17.8 $/b in the spot window (103.7 $/b in total on a…

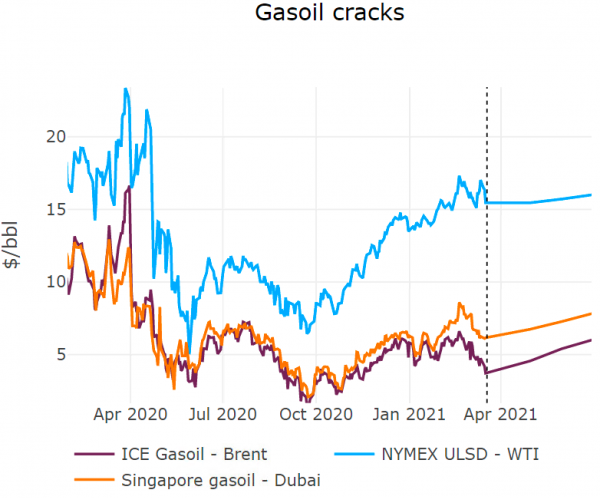

Crude prices continued to weaken on Wednesday despite the dollar edging lower, as the physical market’s weakness filtered through the futures’ market. Weak physical crude markets were combined with crashing diesel cracks, at the centre of refiners’ profitability. US petroleum stocks, reported by the EIA, showed a 3.6 mb build across crude and products. Sustained low refining runs continued to limit the demand side of the crude market. Gasoline shortages were resolved by a massive increase in imports, which will likely maintain cracks at elevated levels.

Get more analysis and data with our Premium subscription

Ask for a free trial here