Carbon prices edged up ahead of ENVI’s vote

The European power spot prices rose yesterday amid forecasts of higher demand induced by the current warm spell, and dropping wind output. The day-ahead prices…

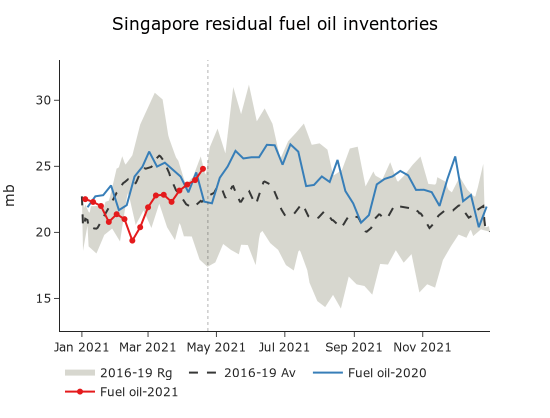

ICE Brent prompt contract hiked to 65.7 $/b, likely due to the sustained backwardation at the prompt. Physical differentials in West Africa continued to weaken, as the Nigerian state oil company lowered its official selling prices for its flagship crudes, as rising Brent-Dubai swaps forced producers to adjust their competitiveness to flow crude to the East. Singapore products drew on the light end side, supporting gasoline cracks in Asia. Rising fuel oil stocks in Asia and the Middle-east will deteriorate prompt fuel oil values globally.

Get more analysis and data with our Premium subscription

Ask for a free trial here