Mixed price evolution

European spot gas prices were mixed yesterday, while curve prices were more clearly downward. The latter continued their technical correction in a context of rather…

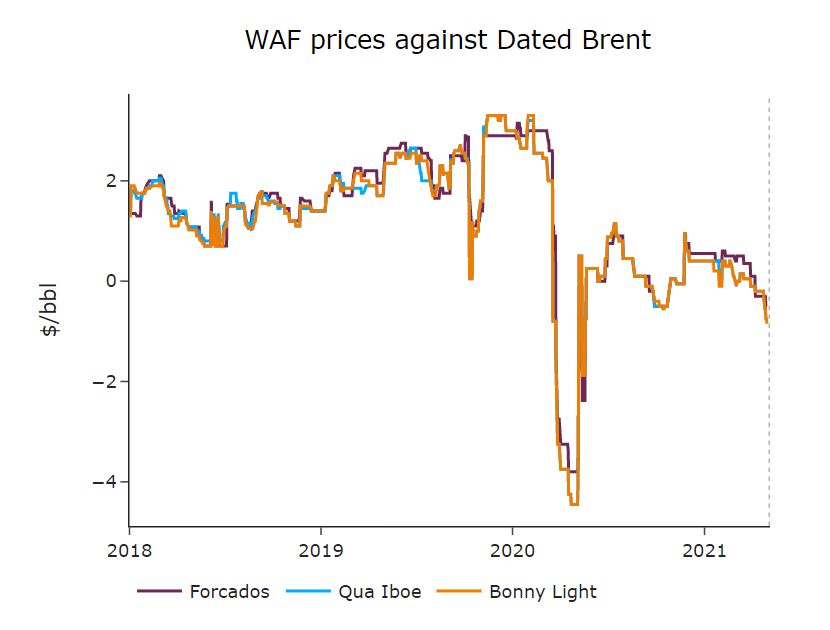

ICE Brent prompt prices rallied to 67.3 $/b, without significant fundamental change. The Dubai benchmark, pricing crude delivered to Asia, continued to weaken compared to European and US crude as the time structure of swaps rapidly worsened. Asian product cracks reacted differently to the Indian health crisis, as gasoil cracks remained supported and gasoline margins underperformed.

Get more analysis and data with our Premium subscription

Ask for a free trial here