The fall in prices interrupted by the blockade of the Suez Canal

Crude oil prices plunged yesterday on raising concerns about global demand fuelled by bad news about the pandemic (see the Daily Eco). API data also…

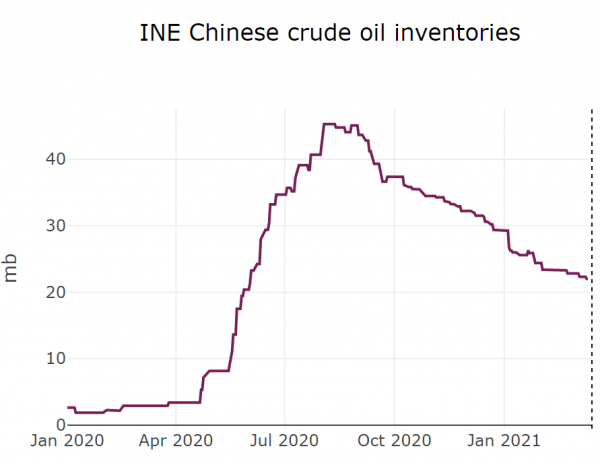

ICE Brent prompt contract was trading at 69.7 $/b on Monday as most Texan refineries were restarted over the weekend. Furthermore, Chinese crude processing in January and February remained strong, at 14.13 mb/d, slightly above our forecasts as fuel consumption during the Lunar New Year break remained strong.

Get more analysis and data with our Premium subscription

Ask for a free trial here