Christmas outages

ICE Brent crude prices rebounded, with ICE Brent February contract touching 75 $/b while time spreads were back in backwardation. Indeed, outages in OPEC countries…

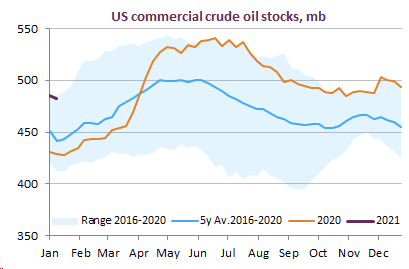

Brent prompt future prices retreated further at 55.7 $/b as growing concerns about the Chinese health situation raised concerns about Chinese oil demand prospects. President Biden unveiled the 1.9 trillion stimulus package designed to limit the economic effects of the pandemic. The US Dept of Energy is planning to release strategic petroleum reserve stocks in April of about 20 mb. Brent time spreads weakened further to reach 1cts, as prompt balances are anticipated to remain weak over February.

Get more analysis and data with our Premium subscription

Ask for a free trial here

We will get back in touch with you soon.

Don’t forget to follow us on twitter!