Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

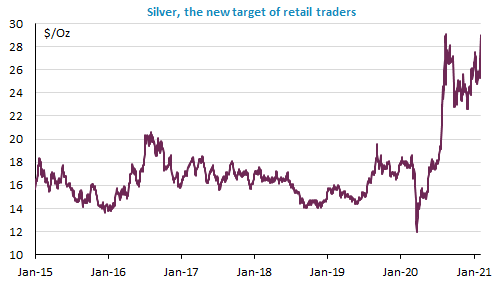

We thought obvious signs of economic slowdown in China could somewhat challenge markets’ optimism yesterday but that did not happen. Progress in the vaccination campaign in the US as well as peaceful negotiations about the stimulus package between Republicans and Democrats were enough to push risky assets higher. The noticeable exception was the USD that kept on strengthening, while it usually weakens in such a context of stronger risk appetite. It seems better prospects of US recovery are prevailing at the moment. Silver prices surged to a 8-year high, before retreating, a new episode in the ongoing battle between individual traders and hedge funds.

Get more analysis and data with our Premium subscription

Ask for a free trial here

We will get back in touch with you soon.

Don’t forget to follow us on twitter!