Prices were mixed again yesterday

European gas prices were mixed again yesterday: slightly down on the spot, slightly up on the curve. Amid ongoing concerns on relatively low Russian supply,…

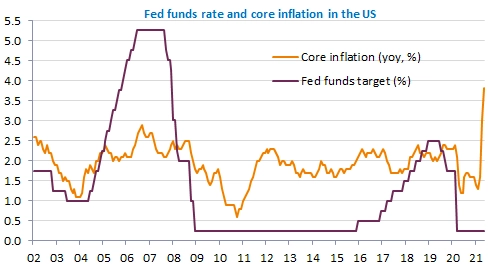

US inflation reached 5% in May, its core component touching its highest level since 1992 at 3.8%. Yet, the market remains convinced this is only temporary. The Fed will meet next week, but the ECB announced it would prolong its extra purchases of bonds, which reinforced the market’s conviction that the Fed would also keep a dovish stance. The US 10y bond yield has fallen below 1.45%. The EUR/USD exchange rate is almost stable, below 1.22.

Get more analysis and data with our Premium subscription

Ask for a free trial here